Published by: Administrator

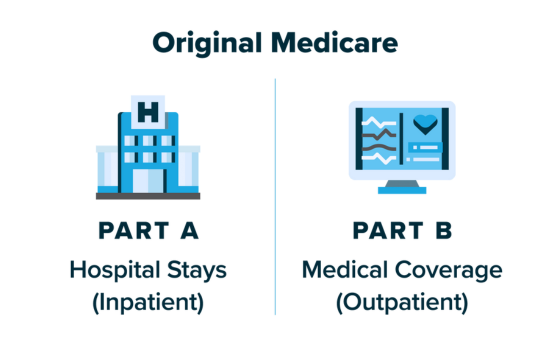

Medicare Part A (Hospital Insurance)

Most people get Part A for free, but some have to pay a premium for this coverage.

To qualify for premium-free Part A, an individual must be eligible to receive Medicare based on their own earnings or those of a spouse, parent, or child. To obtain premium-free Part A, the worker must accumulate a specified number of quarters of coverage (QCs) and submit an application for Social Security or Railroad Retirement Board (RRB) benefits. The number of QCs required varies depending on whether the individual is applying for Part A due to age, disability, or End-Stage Renal Disease (ESRD). Quarters of coverage are earned by paying payroll taxes under the Federal Insurance Contributions Act (FICA) during a person's working years. Most individuals pay the full FICA tax, enabling the QCs they earn to meet the eligibility requirements for both monthly Social Security benefits and premium-free Part A.

[....]